Summary

Market Sentiment: Cautiously optimistic ahead of Jackson Hole, with Powell's dovish signals expected but traders wary of hawkish surprises

Key Theme: Central bank policy divergence meets earnings season climax—focus shifts from data to guidance and geopolitical outcomes

Week Ahead: Key Events & Market Drivers

Monday, August 19

0130 GMT: Singapore NODX exports (July), expected -5.2% YoY vs -8.3% prior

0800 GMT: German Producer Prices (July), expected +0.2% MoM vs -0.1% prior

1230 GMT: US Building Permits (July), consensus 1.44M vs 1.45M prior

1230 GMT: US Housing Starts (July), expected 1.35M vs 1.35M prior

Corporate: Lowe's (LOW), Target (TGT) earnings before market open

Tuesday, August 20

1230 GMT: Canada CPI inflation (July), expected 3.0% YoY vs 2.7% prior

1400 GMT: US Existing Home Sales (July), forecast 3.97M vs 3.95M prior

1800 GMT: FOMC Minutes from July 30-31 meeting - (Critical for rate path clarity)

Corporate: Palo Alto Networks (PANW), Intuit (INTU) after close

Wednesday, August 21

0700 GMT: UK CPI inflation (July), expected 2.1% YoY vs 2.0% prior

0700 GMT: UK Retail Sales (July), forecast +0.3% MoM vs -1.2% prior

0800 GMT: Eurozone Flash PMI surveys - Manufacturing expected 45.2, Services 52.9

1315 GMT: US ADP Employment (August), consensus 145K vs 122K prior

After close: NVIDIA Q2 FY2025 Earnings - Major market catalyst

Thursday, August 22

Jackson Hole Symposium Opens - Theme: "Reassessing the Effectiveness and Transmission of Monetary Policy"

0800 GMT: European Flash PMI (August) - Germany, France, Eurozone composite

1230 GMT: US Initial Jobless Claims, expected 235K vs 227K prior

1330 GMT: US Flash PMI (August) - Manufacturing expected 49.5, Services 54.8

1500 GMT: Fed Chair Powell Speech - "The Path Forward for Monetary Policy"

Friday, August 23

Jackson Hole Continues - ECB's Lagarde (1000 GMT), BoJ's Ueda (1400 GMT)

0800 GMT: German Ifo Business Climate (August), expected 86.5 vs 87.0 prior

1400 GMT: US New Home Sales (July), forecast 625K vs 617K prior

1500 GMT: US Kansas City Fed Manufacturing (August)

Jackson Hole Symposium: Deep Policy Analysis

Powell's Strategic Positioning

Fed Chair Powell faces his most consequential Jackson Hole speech, with markets 85% pricing September rate cuts. The political backdrop is unprecedented—Treasury Secretary Bessent's public push for 50bp cuts creates tension with Fed independence. Three key messaging challenges:

Labour Market Recalibration: Unemployment at 4.3% vs Fed's 4.0% June projection requires acknowledgment without panic signalling

Inflation Credibility: Core CPI at 3.1% YoY demands hawkish undertones despite easing bias

Political Independence: Trump administration pressure tests Fed's institutional credibility

Expected Framework Signals:

September Cut Confirmation: 25bp reduction "highly likely" if data cooperates

Gradual Path Emphasis: Rejection of aggressive 50bp moves or accelerated cycle

Data Dependency: Continued emphasis on incoming inflation/employment metrics

Balance Sheet Guidance: Potential commentary on QT pace given recent slowdown to $5bn/month Treasury caps

Global Central Bank Coordination

The symposium features unprecedented central bank coordination challenges:

ECB President Lagarde (speaking Friday): Recent rhetoric suggests policy pause rather than continued easing. July's upbeat assessment and 2% inflation target achievement reduce urgency for further cuts. Eurozone PMI recovery (Services 52.9 expected) supports hawkish pivot.

BoJ Governor Ueda: Faces yen volatility concerns following recent hawkish moves. USD/JPY at 144 creates intervention risks, but domestic inflation above 2% target supports normalisation.

Market Implications: Central bank divergence creates FX volatility amplification—Powell dovishness + ECB/BoJ hawkishness = potential dollar weakness acceleration.

NVIDIA Earnings: AI Revolution Bellwether

Comprehensive Earnings Analysis

Q2 FY2025 Consensus Expectations:

Revenue: $29.5bn (+109% YoY) vs Q1's record $30.0bn

Data Centre Revenue: $26.3bn expected (88% of total) vs $26.3bn prior quarter

EPS: $0.94 consensus (+133% YoY) vs $0.68 prior

Gross Margin: 75%+ expected, maintaining industry-leading profitability

Critical Catalyst Factors:

1. Blackwell Architecture Transition

Production Timeline: H2 2025 ramp expectations vs supply chain constraints

Customer Pre-orders: Magnitude of next-gen AI chip bookings

Competitive Positioning: vs AMD's MI300 series and Intel's Gaudi accelerators

2. China Export Impact

H20 Chip Revenue: ~$8bn quarterly impact from export restrictions

Compliance Strategy: Navigation of evolving US-China trade policies

Alternative Market Penetration: Europe, Middle East expansion to offset losses

3. AI Infrastructure Scaling

CUDA Platform Moat: 75% supercomputer market share sustainability

Software Revenue: NVIDIA AI Enterprise approaching $2bn annual run rate

Cloud Provider Demand: Microsoft Azure, Amazon AWS, Google Cloud capacity expansion

4. Competitive Dynamics

Market Share Defence: Current 90%+ AI GPU dominance under pressure

Open Source Alternatives: AMD ROCm, Intel OneAPI ecosystem threats

TSMC Dependency: Supply chain risk concentration in Taiwan semiconductor production

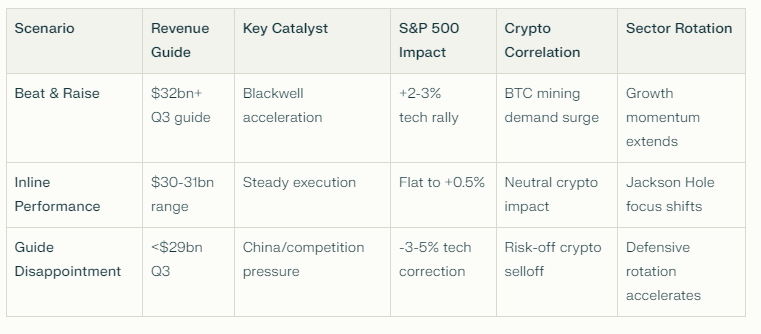

Scenarios from NVDA results

Detailed Cross-Asset Week Ahead

Equities: Technical & Fundamental Convergence

US Markets Positioning:

S&P 500: Consolidating 6,400-6,500 range; 6,468 record high vulnerable to Powell hawkishness

Nasdaq Composite: AI momentum stocks 30% above 200-day MA—correction risk if Nvidia disappoints

Russell 2000: Small-caps 15% below June highs—rate cut sensitivity creates catch-up potential

Sector Allocation Strategy:

Overweight: Utilities (+8% YTD), Healthcare (+12%), Consumer Staples (+6%) for defensive positioning

Underweight: Technology (-2% from peaks), Communication Services (Meta, Google concentration risk)

Tactical: Financials (+4% on steeper yield curve expectations), Industrials (infrastructure spending)

International Exposure:

European Equities: STOXX 600 benefiting from ECB pause, but PMI contraction risks

Emerging Markets: China exposure critical—PMI manufacturing 49.3 signals continued weakness

Japan: Nikkei 225 yen-sensitive positioning ahead of BoJ Jackson Hole commentary

Foreign Exchange: Central Bank Divergence Trades

Dollar Dynamics (DXY ~98.1):

Fundamental Support: 4.25% fed funds rate vs ECB 2.0%, BoE 4.00%

Technical Resistance: 99.5 key level; break higher targets 101-102 range

Powell Sensitivity: Dovish surprise could trigger 95-96 retest

Key Currency Pairs:

EUR/USD (1.17):

Range: 1.15-1.19 pending Jackson Hole outcomes

Lagarde Impact: ECB pause narrative limits euro upside despite tariff concerns

PMI Critical: Eurozone manufacturing 45.2 expected—below 45 triggers weakness

GBP/USD (1.33):

BoE Divergence: Recent cut vs potential Fed easing creates cross-currents

Inflation Key: UK CPI 2.1% expected vs Fed's 2.7%—relative outperformance

Brexit Resolution: Northern Ireland protocol clarity reduces political risk premium

USD/JPY (144):

Intervention Zone: BoJ verbal warnings intensify above 145

Carry Trade Unwinding: 200bp US-Japan rate differential creates volatility

Technical: 142-146 range; break either direction triggers 400-pip moves

Fixed Income: Duration Strategy Refinement

US Treasury Dynamics:

10-Year Yield (4.25%): Jackson Hole dovishness targets 3.90-4.10% range

2s/10s Spread: 53bp positive spread—steepening continues on Fed easing expectations

FOMC Minutes Impact: July meeting dissent details critical for market pricing

Global Bond Allocation:

Duration Extension: Favour 7-10 year maturities for Fed easing cycle positioning

Credit Selection: Investment grade corporates over high yield (recession hedging)

International: German Bunds benefit from ECB pause; UK Gilts supported by BoE caution

Yield Curve Strategy:

Steepening Trades: Long 10-year vs short 2-year positioning for policy normalization

Real Rates: TIPS breakevens at 2.1%—attractive inflation hedging at cycle peaks

Municipal Bonds: $55bn August reinvestment calendar supports technicals

Commodities: Macro Sensitivity Analysis

Energy Complex:

Oil: WTI $63, Brent $66—oversold technically but fundamentally challenged

Demand Concerns: China PMI 49.3 signals consumption weakness

Supply Dynamics: OPEC+ production additions offset geopolitical support

Trading Range: WTI $60-68, Brent $64-72 pending demand clarity

Precious Metals:

Gold ($3,440/oz): Fed dovishness + geopolitical premium = $3,600+ targets

Silver: Industrial demand component benefits from AI infrastructure spending

Platinum/Palladium: Auto sector weakness limits upside despite supply constraints

Industrial Metals:

Copper: China construction weakness vs US infrastructure spending—range-bound

Aluminium: Energy cost pressures support prices despite demand concerns

Steel: Trade policy uncertainty creates volatility around $800/tonne levels

Agriculture: Weather-driven volatility dominates; soft commodities outperforming grains

Crypto Assets: Institutional Adoption Acceleration

Bitcoin Fundamentals ($118k+):

ETF Inflows: $2.1bn net inflows in August—institutional adoption accelerating

Mining Economics: Network hash rate at records despite energy cost pressures

Regulatory Clarity: 401(k) inclusion proposals boost long-term demand profile

Technical Levels: Support $115k, resistance $125k—Jackson Hole volatility expected

Ethereum Ecosystem ($4,300+):

Staking Yields: 3.2% returns attractive vs traditional fixed income

DeFi Integration: Total value locked approaching $100bn—ecosystem maturation

Corporate Adoption: Tesla, MicroStrategy balance sheet allocations continue

Altcoin Selection:

AI Tokens: NVIDIA earnings impact on blockchain infrastructure demand

DeFi Leaders: Uniswap, Aave benefit from traditional finance integration

Layer 1s: Solana, Cardano positioning for institutional smart contract adoption

Weekly Catalysts for Crypto:

Fed Policy: Dovish Jackson Hole = liquidity-driven rally continuation

Nvidia AI Narrative: Chip demand spillover to crypto mining infrastructure

Regulatory Progress: SEC clarity on Ethereum ETF approval timeline

Macro Risk: China PMI weakness vs US resilience creates BTC safe-haven testing

Risk Management Framework:

Core Allocation: 60% BTC, 30% ETH, 10% selective altcoins

Volatility Hedging: 20% cash equivalent for Jackson Hole price swings

Technical Stops: BTC below $115k triggers profit-taking; ETH $4,000 key support

Risk Scenario Matrix & Tactical Positioning

Upside Scenarios (Probability: 45%)

1. Dovish Fed + Nvidia Beat (25% probability)

Triggers: Powell signals aggressive easing + NVIDIA revenue $32bn+ guide

Asset Response: S&P 500 to 6,600, Bitcoin to $130k, DXY to 95

Duration: 2-4 weeks before fundamental concerns resurface

2. China Stimulus Surprise (20% probability)

Catalyst: PBOC rate cuts + fiscal spending announcement

Impact: Commodities +5-8%, EM currencies rally, industrial metals surge

Timing: Late August following PMI disappointments

Downside Scenarios (Probability: 35%)

1. Hawkish Powell Surprise (15% probability)

Trigger: Fed Chair emphasizes inflation persistence over labour weakness

Response: DXY to 101, S&P 500 to 6,200, Bitcoin to $105k

Duration: 1-2 weeks before dip-buying emerges

2. Nvidia Guidance Miss (20% probability)

Catalyst: Q3 revenue guide below $29bn due to China restrictions

Sector Impact: Nasdaq -8%, semiconductor ETFs -15%

Ripple Effects: AI tokens -25%, broader tech rotation accelerates

Base Case Scenario (Probability: 20%)

Balanced Outcomes:

Powell dovish but measured (25bp September confirmed, gradual pace)

Nvidia meets expectations ($30bn guide, Blackwell timeline intact)

PMI data mixed (US resilient, Europe/China soft)

Range-bound trading until September FOMC clarity

Tactical Positioning Framework

Pre-Jackson Hole (Through August 22):

Reduce Risk: Trim 20% equity overweight, raise cash to 15%

Hedge Positions: Buy VIX calls, short duration options

Currency: Neutral USD positioning pending Powell clarity

Post-Jackson Hole (August 23+):

Dovish Response: Add growth equities, extend duration, buy crypto dips

Hawkish Surprise: Defensive rotation, dollar strength, gold accumulation

Balanced Outcome: Maintain strategic allocations, focus on September setup

September Preview & Strategic Outlook

Key Events Approaching:

September 18 FOMC: First rate decision post-Jackson Hole guidance

September NFP: Labour market trajectory confirmation ahead of policy shift

Q3 Earnings Season: Confirmation of AI investment sustainability

Long-term Themes (Q4 2025 positioning):

AI Infrastructure Maturation: Beyond NVIDIA to broader ecosystem beneficiaries

Central Bank Normalisation: End of extraordinary policy era across DM economies

Geopolitical Realignment: Trade policy impact on global supply chains

Demographic Transitions: Aging populations effect on growth/inflation dynamics

Portfolio Construction Principles:

Quality over Growth: Earnings visibility paramount in late-cycle environment

Geographic Diversification: US growth vs international value opportunities

Alternative Allocations: Crypto (5-10%), Commodities (5%), Real Assets (10%)

Liquidity Management: 10-15% cash for tactical opportunities

Bottom Line: Jackson Hole represents the most significant macro catalyst since June FOMC pivot. Powell's dovish confirmation combined with Nvidia's AI leadership validation could extend risk asset rallies through September. However, any hawkish surprise or earnings disappointment triggers immediate defensive positioning. Week ahead success requires tactical agility within strategic framework discipline.

Next Update: Real-time Jackson Hole reaction analysis, Nvidia earnings deep dive, and September FOMC probability recalibration

Risk Disclaimer: This analysis reflects current market conditions as of August 17, 2025. Rapid changes in economic data, geopolitical developments, or central bank communications could materially alter the outlook. Diversification and appropriate risk management remain essential in the current environment. None of this is financial advice, Wizard Macro Research cannot be held responsible for any losses